Key Takeaways 1. The EU Battery Regulation (2023/1542) applies to ALL batteries entering Europe – including used hybrid packs from non-EU countries. 2. NiMH hybrid batteries are classified under UN 3496 for sea transport; Li-ion packs fall under the stricter UN 3480/3481 across all modes. 3. From August 2026, every EU-bound hybrid battery must carry QR-code labels with material composition, capacity and safety data. 4. The digital Battery Passport becomes mandatory from February 2027 for EV and industrial batteries above 2 kWh. 5. Compliant, well-documented packs already command premium prices – the gap with undocumented stock will widen through 2026-2027. 6. Collectors in India, the UAE, Saudi Arabia, the USA and Australia should build SoH testing and documentation workflows now to secure EU market access. |

The EU Battery Regulation (2023/1542) is reshaping the rules for every battery that enters the European market – including used hybrid battery packs imported from outside the EU. This guide explains what collectors and exporters in India, the UAE, Saudi Arabia, the USA, Australia and other non-EU countries need to know about labelling, documentation, traceability and compliance to keep shipping hybrid batteries to Europe in 2026 and beyond.

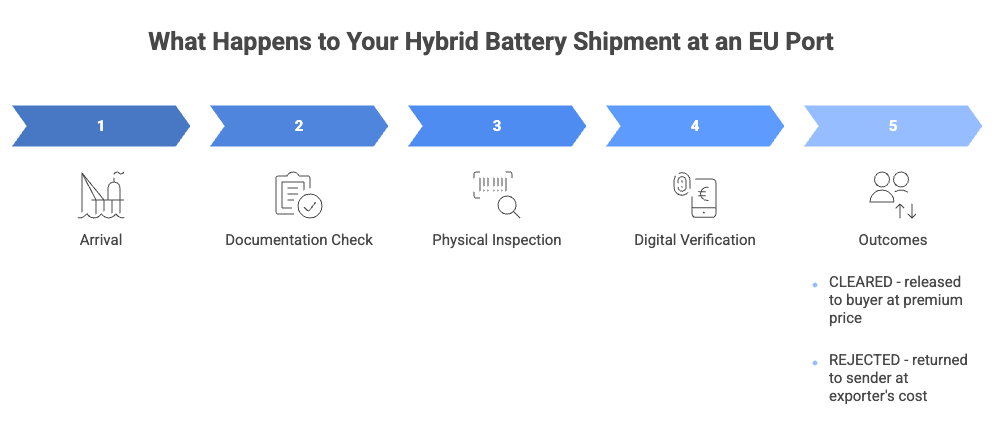

From 2026, any used hybrid battery entering the EU must meet new labelling standards, including QR codes and material-composition markings. Each shipment must come with documentation proving the battery’s State of Health (SoH). Packs must carry the correct UN hazardous-goods classification – typically UN 3496 for nickel metal hydride battery packs shipped by sea, or UN 3480/3481 for lithium-ion units. From February 2027, batteries above 2 kWh placed on the EU market must also be linked to a digital Battery Passport. Collectors who fail to meet these standards risk border rejections, fines and loss of access to the world’s largest battery recycling and second-life market.

What Is the EU Battery Regulation and Does It Apply to Used Hybrid Batteries?

Yes – the EU Battery Regulation applies to all batteries placed on the European market, including used and second-life packs imported from outside the EU.

Regulation (EU) 2023/1542 entered into force on 17 August 2023, replacing the older 2006 Battery Directive. Unlike its predecessor, this regulation is directly enforceable across all 27 EU member states without requiring national transposition. Its scope covers the entire battery lifecycle – from raw material sourcing and manufacturing through to reuse, recycling and end-of-life management.

For hybrid battery collectors outside Europe, the critical point is that the regulation draws no distinction between new and used batteries. A ten-year-old Toyota Prius NiMH pack shipped from Dubai to Rotterdam must meet the same labelling, documentation and traceability obligations as a brand-new industrial cell manufactured in Germany. According to the compliance team at Recohub, this single fact is what most non-EU collectors underestimate when planning shipments to European buyers.

The regulation categorises batteries into several groups: portable, industrial (above 2 kWh), EV, light means of transport (LMT), SLI (starting, lighting, ignition) and stationary energy storage. Most hybrid vehicle battery packs – including the widely traded Toyota Prius NiMH modules at 201.6V and 6.5 Ah – fall under the industrial or EV battery classification depending on their rated capacity. The specific category determines which obligations apply and when.

The full legal text is published on EUR-Lex (Regulation 2023/1542). Below is a summary of the key milestones that affect hybrid battery exporters.

Table 1: EU Battery Regulation – Key Milestones for Hybrid Battery Exporters

Date | Requirement | Impact on Hybrid Battery Exporters |

August 2025 | Enhanced labelling and CE marking obligations take effect | All batteries placed on EU market must carry compliant labels with capacity, chemistry and disposal info |

February 2026 | Carbon footprint declarations mandatory for industrial rechargeable batteries >2 kWh | Exporters shipping larger hybrid packs (e.g. full EV-capacity modules) must provide carbon footprint data per EU methodology |

August 2026 | Harmonised labelling expands; QR codes required on battery labels | Physical labels on every hybrid battery pack must include QR code linking to material composition, safety and performance data |

February 2027 | Digital Battery Passport mandatory for EV and industrial batteries >2 kWh | Each qualifying battery must carry a unique digital identifier accessible via QR code with full lifecycle data |

August 2027 | Due diligence obligations apply (postponed from 2025); minimum durability standards for industrial batteries | Economic operators with >€40M turnover must implement supply chain due diligence; batteries must meet performance thresholds |

August 2028 | Recycled content disclosure for cobalt, lead, lithium and nickel | Batteries must declare recycled material ratios for critical metals |

August 2031 | Minimum recycled content percentages enforced | EV and industrial batteries must contain minimum 16% cobalt, 85% lead, 6% lithium and 6% nickel from recycled sources |

Which Hybrid Battery Types Are Affected and How Are They Classified for Export?

Every hybrid battery type in the global secondary market falls within the regulation’s scope, but the transport classification depends on the pack’s chemistry.

The two dominant chemistries in used hybrid vehicle batteries are nickel metal hydride (NiMH) and lithium-ion (Li-ion). NiMH remains the most widely traded type globally, driven by the enormous installed base of Toyota Prius, Honda Insight, Lexus RX and Camry Hybrid vehicles. More recent hybrids increasingly use Li-ion cells, which carry different and generally stricter transport requirements.

For international shipping, the UN classification system determines how each battery type must be packaged, labelled and declared:

NiMH Hybrid Batteries (UN 3496)

Used nickel metal hydride battery packs are classified under UN 3496 (Batteries, nickel-metal hydride) for sea transport under the IMDG Code. An important distinction: UN 3496 applies specifically to maritime shipping. For air transport, NiMH batteries are generally considered “not restricted” under IATA Special Provision A199, provided terminals are insulated against short circuits and the batteries are packaged to prevent dangerous heat generation. For ocean shipments exceeding 100 kg gross mass per container, a Dangerous Goods Declaration is required under IMDG Code sections 5.4.1 and 5.4.3.

Li-Ion Hybrid Batteries (UN 3480 / UN 3481)

Lithium-ion hybrid packs are classified under UN 3480 (lithium-ion batteries, standalone) or UN 3481 (lithium-ion batteries contained in or packed with equipment). Li-ion batteries face stricter transport regulations across all modes – air, sea and road. Packing Instructions PI 965-PI 970 under IATA DGR apply depending on configuration. State of Charge (SoC) should be maintained at 30-50% for safe transit. Damaged or defective Li-ion packs may require Special Provisions SP 376 or SP 377, which impose additional packaging and notification requirements.

Table 2: Common Hybrid Battery Types and Their Transport Classification

Vehicle Model | Chemistry | Voltage / Capacity | UN Code (Sea) | Notes |

Toyota Prius Gen 2 (2004-2009) | NiMH | 201.6V / 6.5 Ah | UN 3496 | Most widely traded hybrid battery globally; 28 modules per pack |

Toyota Prius Gen 3 (2010-2015) | NiMH | 201.6V / 6.5 Ah | UN 3496 | Similar to Gen 2; high aftermarket demand for second-life use |

Toyota Camry Hybrid | NiMH | 244.8V / 6.5 Ah | UN 3496 | 34 modules per pack; strong volumes in USA and Australia |

Honda Insight (Gen 1) | NiMH | 144V / 6.5 Ah | UN 3496 | Smaller pack; 120 cells; common in Japan-origin export markets |

Lexus RX 400h / 450h | NiMH | 288V / 6.5 Ah | UN 3496 | Premium segment; higher voltage; good second-life value |

Ford Escape Hybrid | NiMH | 330V / 5.5 Ah | UN 3496 | Large US installed base; 250 cells per pack |

Toyota Prius Gen 4 (2016+) | Li-ion | 207.2V / 3.6 Ah | UN 3480 | Transition to Li-ion; stricter transport rules apply |

Hyundai Ioniq Hybrid | Li-ion polymer | 240V / 1.56 kWh | UN 3480 | Growing volumes; requires Li-ion packing instructions |

What Labelling and Documentation Do Hybrid Battery Exporters Need for EU Compliance in 2026?

Every EU-bound hybrid battery shipment must include a complete documentation package covering the battery’s identity, condition, chemistry and transport classification.

The EU Battery Regulation introduces layered documentation requirements that phase in between 2025 and 2027. For collectors shipping used hybrid packs today, the practical compliance burden centres on five areas: labelling, State of Health reporting, hazardous goods classification, chain-of-custody records and – from February 2027 – the digital Battery Passport.

Labelling requirements under the regulation expand from August 2026 to include QR codes that link to material composition, expected lifespan, capacity and safe disposal information. These labels must appear on the battery itself, not just on the outer packaging. For used hybrid packs, this means collectors or their export partners must apply compliant labels before shipment if the original manufacturer’s labelling does not meet the new standard.

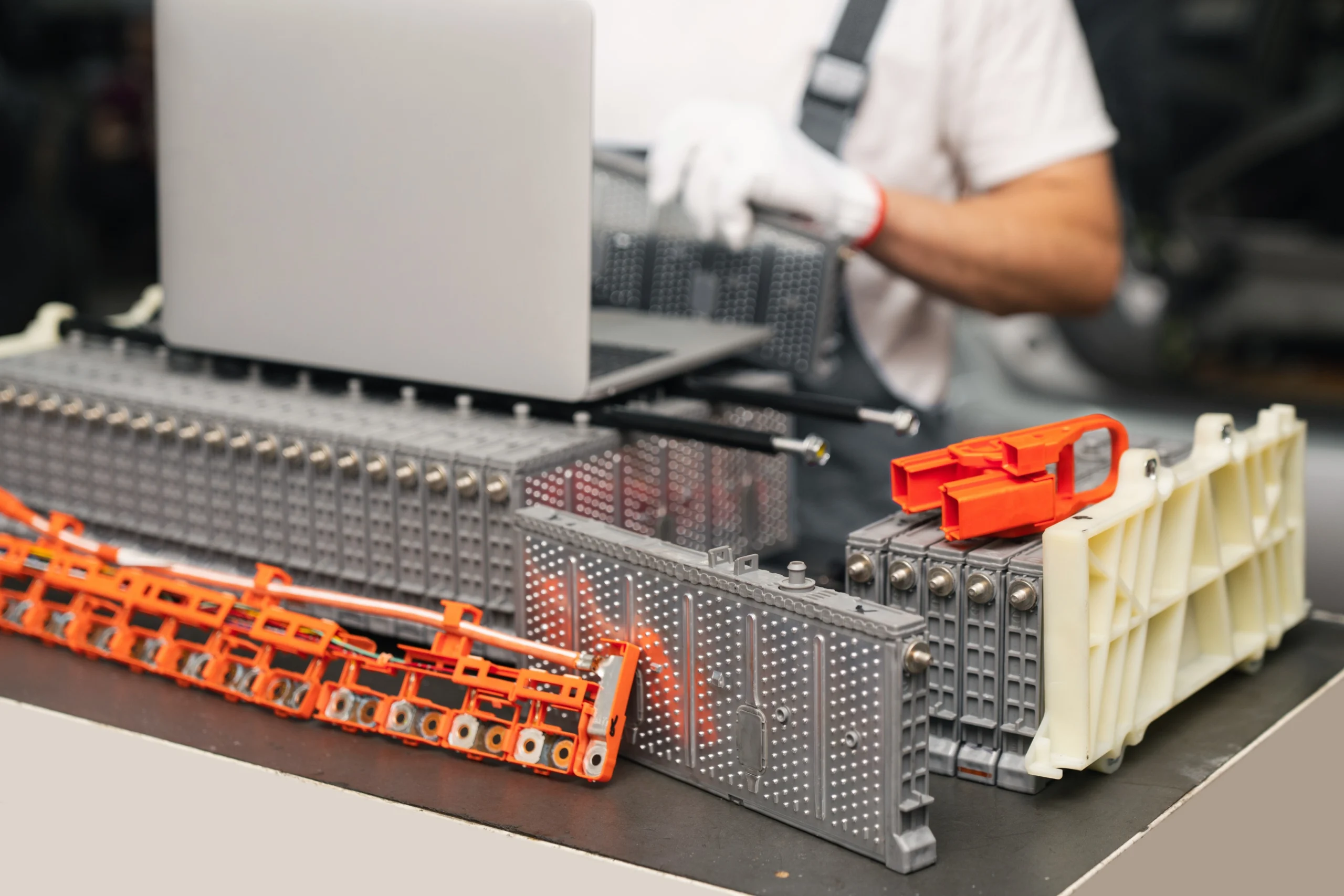

State of Health documentation has become a de facto requirement for any commercial transaction involving used hybrid batteries in Europe. EU buyers increasingly require SoH test reports showing remaining capacity, internal resistance measurements and charge-discharge cycle data. A detailed guide to pre-export testing is available in the hybrid battery health check guide published by Recohub.

Collectors working with Recohub benefit from end-to-end documentation support – from initial battery testing and grading through to compliant labelling, UN classification certificates and chain-of-custody records that satisfy EU importer requirements.

Table 3: Documentation Checklist for EU-Bound Hybrid Battery Shipments

Document | Required By | Description |

State of Health (SoH) Test Report | 2026 (de facto market requirement) | Remaining capacity %, internal resistance, cycle count and charge-discharge test results for each pack or module batch |

UN Hazardous Goods Classification Certificate | Ongoing (IMDG / IATA / ADR) | Correct UN number (3496 for NiMH sea, 3480/3481 for Li-ion), packing group and transport category with shipper declaration |

Material Composition Declaration | August 2026 | Chemistry type, hazardous substance content, critical raw material percentages (nickel, cobalt, lithium, lead) per EU format |

QR Code Label (on battery) | August 2026 | Machine-readable label on the physical battery linking to digital records on composition, capacity, safety and disposal |

Chain-of-Custody Record | 2026 (best practice, mandatory from 2027) | Documented trail from vehicle dismantling through collection, testing, grading and export – proving provenance and handling |

Dangerous Goods Declaration (DGD) | Ongoing (shipments >100 kg NiMH by sea) | IMDG-compliant declaration for ocean freight of NiMH packs classified under UN 3496, SP 963 |

Digital Battery Passport | February 2027 | Unique identifier with QR code providing lifecycle data, SoH history, material composition, carbon footprint and recycled content |

How Can Collectors in India, the UAE, the USA and Australia Prepare for the 2026 Rules?

Collectors in every major hybrid battery source market should start by mapping their inventory against EU classification requirements and building compliant documentation workflows now – not when the 2027 Battery Passport deadline arrives.

The hybrid battery price that European buyers are willing to pay is increasingly tied to compliance readiness. Well-documented packs with SoH reports, correct UN classification and traceable provenance are already commanding premium prices over undocumented stock. This two-tier market will only sharpen as regulation enforcement tightens through 2026 and 2027.

India

India’s hybrid vehicle fleet is growing rapidly, with significant volumes of Maruti, Toyota and Honda hybrids generating end-of-life battery packs. The emerging Indian export sector is cost-sensitive, making compliance investment a strategic decision. Collectors should focus on establishing affordable testing protocols, partnering with certified dismantlers and building documentation templates that can scale. Export logistics from Indian ports to EU destinations require familiarity with IMDG Code requirements for UN 3496 NiMH shipments, which many Indian freight forwarders are still learning.

UAE and GCC

The UAE is already a major re-export hub for used hybrid batteries, with high volumes of Japanese and American import vehicles generating packs in Dubai, Sharjah and Abu Dhabi. Gulf-based collectors are well-positioned to leverage existing logistics infrastructure for EU-bound loads. Recohub‘s regional presence means UAE and GCC collectors can access pre-shipment testing, grading and EU-compliant documentation without building these capabilities in-house. The key advantage is speed: collectors in the Gulf can move from collection to EU-ready shipment faster than competitors in other regions.

United States

The USA holds one of the world’s largest installed bases of hybrid vehicles, with millions of Gen 2 and Gen 3 Prius units, Camry Hybrids and Ford Escape Hybrids now reaching end-of-life. American yards and traders searching for EU-compliant outlets need to align their processes with both US DOT requirements (49 CFR, Special Provision 130 for NiMH) and EU import standards simultaneously. Compliance-ready US exporters who invest in SoH testing and proper documentation will capture premium pricing from European recyclers and second-life buyers.

Australia

Australia’s growing Prius and Camry fleet is reaching the age where battery replacements are common, but domestic recycling capacity remains limited. This makes export the natural outlet for collected packs. Australian collectors face longer shipping routes to Europe, which makes proper packaging and classification even more important – a rejected shipment represents a significant financial loss when freight costs are high. Starting with correct UN classification and robust SoH documentation is essential.

Saudi Arabia

Hybrid adoption in Saudi Arabia is increasing, and collection infrastructure is developing alongside it. Collectors in the Kingdom should focus on building relationships with EU-compliant export partners and establishing testing protocols early. A comprehensive overview of end-of-life processing options is available in the hybrid battery recycling process local guide on recohub.com.

What Is the Battery Passport and When Will It Be Required for Hybrid Battery Exports?

The digital Battery Passport becomes mandatory for EV and industrial batteries above 2 kWh from February 2027, creating a permanent digital record that follows each battery from production through to recycling.

The Battery Passport is the EU’s most ambitious traceability requirement. Each qualifying battery must carry a unique identifier – accessible via a QR code physically marked on the battery – that links to a digital record containing the battery’s chemical composition, carbon footprint data, manufacturing origin, performance specifications and State of Health history. The European Commission’s aim is full lifecycle transparency: any economic operator, regulator or recycler should be able to scan a battery and access its complete history.

For hybrid battery exporters outside Europe, the Battery Passport requirement means that by February 2027, every pack shipped to the EU above the 2 kWh threshold must enter the European market with a compliant digital record. The practical challenge is that most used hybrid batteries were manufactured years before the Battery Passport system existed, meaning the exporter or their EU import partner must create and populate the passport record using available data.

This is where pre-export testing and documentation become critical. Collectors who capture SoH data, photograph pack identification labels, record vehicle origin information and document the dismantling and handling chain are building the raw material for a compliant Battery Passport – even before the formal IT systems are fully operational.

At Recohub, the team is building traceability infrastructure designed to help collectors in India, the UAE, the USA, Australia and Saudi Arabia meet the Battery Passport requirement. A full breakdown of required documentation and the traceability process is available at recohub.com. Exporters who begin systematically capturing battery data now will be ahead of competitors when the February 2027 deadline arrives.

Conclusion: Compliance Is the New Competitive Advantage

The EU Battery Regulation is raising the bar for every hybrid battery entering Europe. For non-EU collectors, it represents both a challenge and an opportunity. Those who invest in proper testing, documentation and classification now will secure access to the world’s most valuable battery recycling and second-life market – at premium prices. Those who delay risk finding their shipments rejected at EU borders as enforcement tightens through 2026 and 2027.

The collectors who will succeed are the ones who treat compliance as a competitive advantage rather than a cost. Building SoH testing capability, capturing provenance data and ensuring correct UN classification are investments that pay for themselves through higher hybrid battery prices and reliable access to EU buyers.

Ready to start exporting hybrid batteries to Europe with confidence? Visit recohub.com to connect with the team, get a free export compliance assessment and access hybrid batteries near me collection points in your region.

FAQ

Does the EU Battery Regulation apply to used hybrid batteries imported from outside Europe?

Yes. Regulation (EU) 2023/1542 applies to all batteries placed on the European market, including used, refurbished and second-life hybrid battery packs. Importers and economic operators must meet labelling, documentation and traceability requirements regardless of the battery’s country of origin. This includes packs from vehicles like the Toyota Prius, Honda Insight and Lexus hybrids that make up the bulk of global secondary market volumes.

What UN classification code applies to used hybrid NiMH batteries for export shipping?

Most used hybrid nickel metal hydride battery packs are classified under UN 3496 (Batteries, nickel-metal hydride) for sea transport under the IMDG Code. This UN number applies specifically to maritime shipping. For air transport, NiMH batteries are generally “not restricted” under IATA Special Provision A199, provided they are packaged to prevent short circuits and dangerous heat generation. Lithium-ion hybrid batteries fall under the stricter UN 3480 or UN 3481 classification across all transport modes.

When does the digital Battery Passport become mandatory for hybrid battery exports to the EU?

The Battery Passport is required for EV and industrial batteries above 2 kWh from February 2027. It will include a unique identifier accessible via QR code, containing lifecycle data, State of Health history, material composition and carbon footprint information. Exporters should start building systematic data capture processes now. Further guidance on the Battery Passport timeline and preparation steps is available from the European Commission’s batteries page.

How does the EU Battery Regulation affect hybrid battery prices for collectors outside Europe?

The regulation is creating a two-tier market. Compliant, well-documented packs with SoH test reports, correct UN classification and traceable provenance will command premium hybrid battery prices from EU buyers. Undocumented or non-compliant packs face declining demand and risk border rejections. The price gap between compliant and non-compliant stock is expected to widen significantly through 2026 and 2027 as enforcement tightens and EU importers face growing scrutiny.

How can hybrid battery collectors in India, the UAE or the USA start exporting to Europe compliantly?

Start with proper battery testing and State of Health grading – a detailed guide is available in the hybrid battery health check guide. Next, ensure correct UN hazardous goods classification (UN 3496 for NiMH sea transport, UN 3480/3481 for lithium-ion). Prepare the required documentation package including SoH reports, material composition declarations and chain-of-custody records. Finally, work with a compliance-ready export partner like Recohub who handles EU Battery Regulation alignment end-to-end, from testing through to documentation and buyer matching.